Let’s put aside the concerns of investors, big and small for a moment and be realistic about the goal of having houses, apartments, and other forms of accommodation. What’s the purpose? To home people. People live in these and their planning, construction, and sale are a function of the need for shelter, which all humans have shared in common since we first huddled in caves and made straw huts at the birth of homo-sapiens. So, if in the process of planning, construction, and sale of these tools, more people in a given place are homed rather than not, then a system can be said to be functioning as it should: housing people.

A second metric we should consider is the pattern in which a person, homed in such an accommodation, are free to use it without the burden of its probable loss. One needs the security to know that it will remain in their possession, so they can manage affairs external to their accommodation. We can therefore, say that housing is one of the most essential needs, like food, water, clothing, so forth. In fact, food, clothing and so forth for people are in their homes and protected from the elements, and other external factors. So, in evaluating a system of housing human beings, we should look at how many people are able to find housing that they will be able to retain and use this as the basis of their going about other activities. These secondary activities might be educational, health related or even pertain to friendship and so forth.

Western economists often decry China’s real estate system as in ‘crisis.’ For example, The Diplomat recently headlined an article on December 21st, 2024, that “China’s Real Estate Crisis: Why the Younger Generation Is Not Buying Houses Anymore.” What is bizarre is that Chinese millennials have 70% homeownership rate, as compared to the United States which has a 39% homeownership rate as of 2022, according to the US based National Association of Realtors.1 So Chinese young people have a far, far better ownership rate. Moreover, most Chinese young people are able to buy their homes in cash. In the US about half of all homes are partly owned by banks through mortgages.

Another example of media disconnected from the basic facts is FirstPost’s article on December 26th, 2024. This is entitled “Falling rents in China expose its crippled real estate sector and a deeper economic flaw.” This is strange because they don’t attempt to put the information, they are presenting in broader context. Homeownership among all Chinese families is 93% whereas, according to the Federal Reserve Bank of St. Louis, home ownership in the United States among all adults is 65.5%, again with the banks owning about half of the value.2 So, rents are depreciated in China because people already have their own home, most often with no mortgage whatsoever.

Furthermore, the number of U.S. households increased by just 10.1 million from 2010 to 2020, fewer than in any other decade between 1950 and 2010. As an American, I wish we had these problems at home.

But, economists, who have made their opulent wages trashing China will argue something like the following: China homes have decreased in value, with investors losing. Some will add that families, with few alternative investments bought many homes and are now holding estates which are less valuable than they were at the time of their purchase. So let’s address these concerns too.

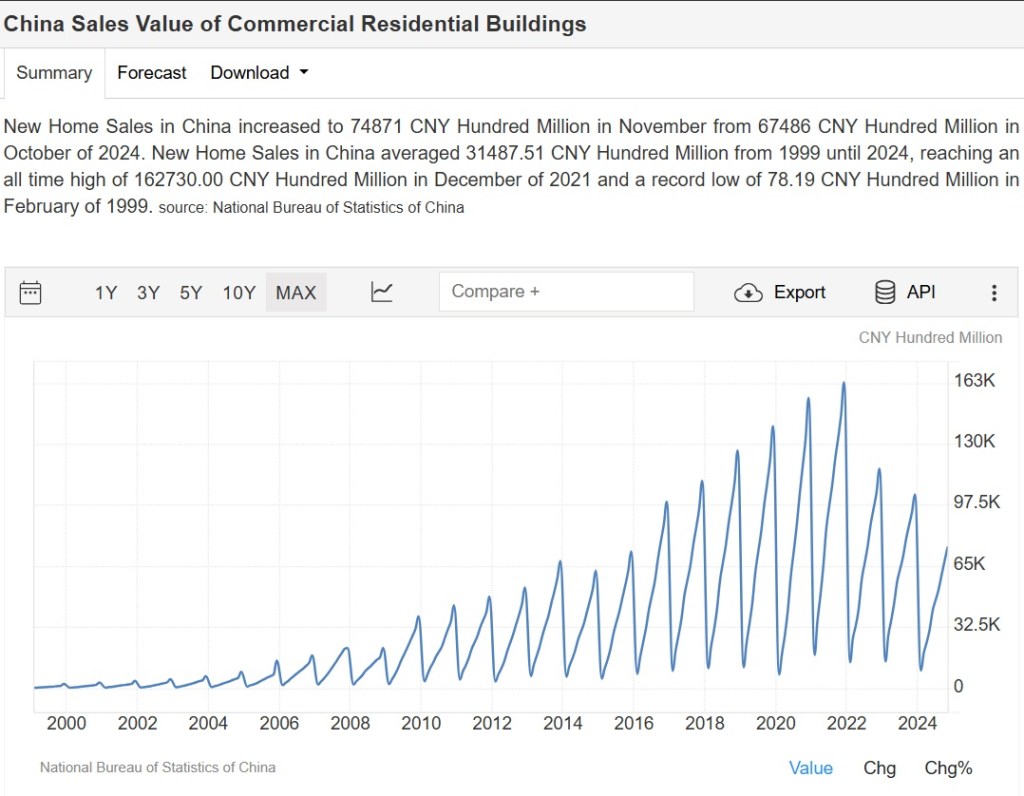

As for rich speculators, investing in people’s homes, we have seen the effect on the US housing situation. So, let’s take a deeper dive into the case of Chinese families with multiple homes. According to Trading Economics (dot) come, the sales value of Commercial Residential Buildings has returned from 2022 highs to the value in 2016. So, all the Chinese families who bought real estate before 2015 or so are still hold apartments which are of relatively equal value. And anyone far before that has still vastly increased the value of their investment. It’s only this who bought extra apartments from 2017, or so, up to now that have seen some of the value of their extra apartments decrease in value.

As for single home families. As they generally don’t have mortgages and certainly don’t have situations where their payments are going up, this is nothing like what happened in the US in 2008. China’s real estate sector is doing what it supposed to do: housing most people, where most people don’t have housing debt.

Let me explain that again in light of where we began. A housing system should house people. That’s exactly what China’s system has accomplished. 93% of Chinese families own their own homes and the banks in China own a far smaller part of that pie. Does China have a housing problem? Certainly not. In fact, as we have shown, the US should learn more about China’s system, as the US’ system of housing people isn’t working as well as China’s is. To quote China’s President Xi Jinping: “houses are for living in not for speculation.”

Leave a comment